CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Every chief executive is figuring out the right balance for new hybrid business models. Regardless of the chosen approach, which will vary, technology executives understand they must accelerate digital and build resilience as well as optionality into their platforms.

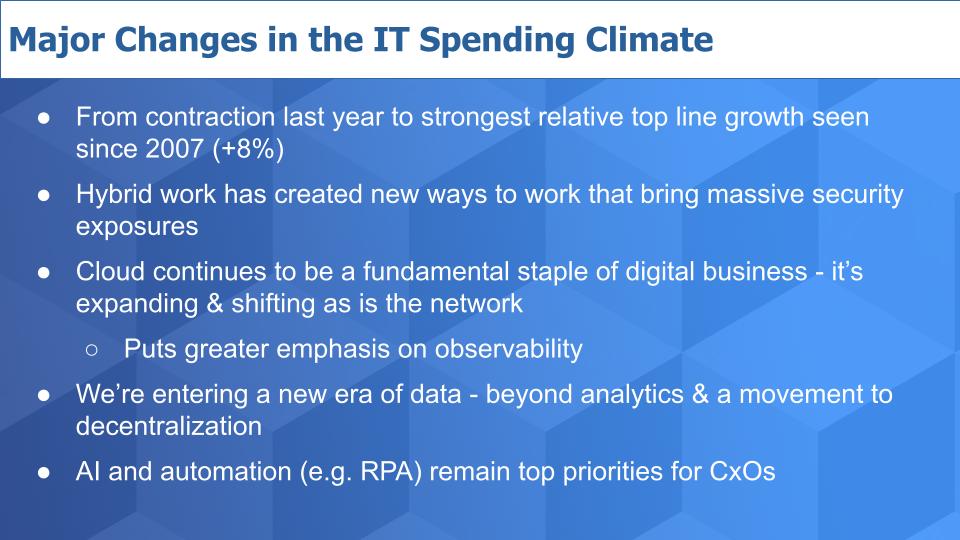

This is driving a dramatic shift in information technology investments at the macro level as we expect total spending to increase at 8% in 2021, a big turnaround from last year’s contraction. Investments in cybersecurity, cloud, collaboration to enable hybrid work and data, including analytics, artificial intelligence and automation are the top spending priorities for CxOs.

In this Breaking Analysis we welcome back Erik Bradley, chief engagement strategist at our partner Enterprise Technology Research. In this post we’ll share some takeaways from ETR’s latest survey and provide our commentary on what it means for markets, sellers and buyers. We’ll also explain what we think Wall Street is missing about Amazon’s latest earnings.

Last year, we saw a contraction in IT budgets by 5% and in 2021, the data shows a snapback to at least 8% growth relative to last year. You have to go back to 2007, just before the financial crisis, to see this type of top-line growth.

The shift to hybrid work has exposed us to new and insidious security threats, as we’ll discuss in more detail.

Cloud migration picked up dramatically last year and, based on the recent earnings results of the big cloud players, that trend continues as organizations accelerate their digital platform build outs. This is bringing complexity and a greater need for so-called observability solutions, which Erik will talk about extensively later on in this segment.

Data is entering a new era of decentralization and we see organizations not only focused on analytics and insights but actually creating data products. Leading technology organizations such as JPMorgan Chase are heavily leaning into this trend toward packaging and monetizing data products.

Finally, as part of the digital transformation trend, we see no slowdown in spending momentum for AI and automation generally, and robotic process automation specifically.

Erik Bradley comments on the macro picture.

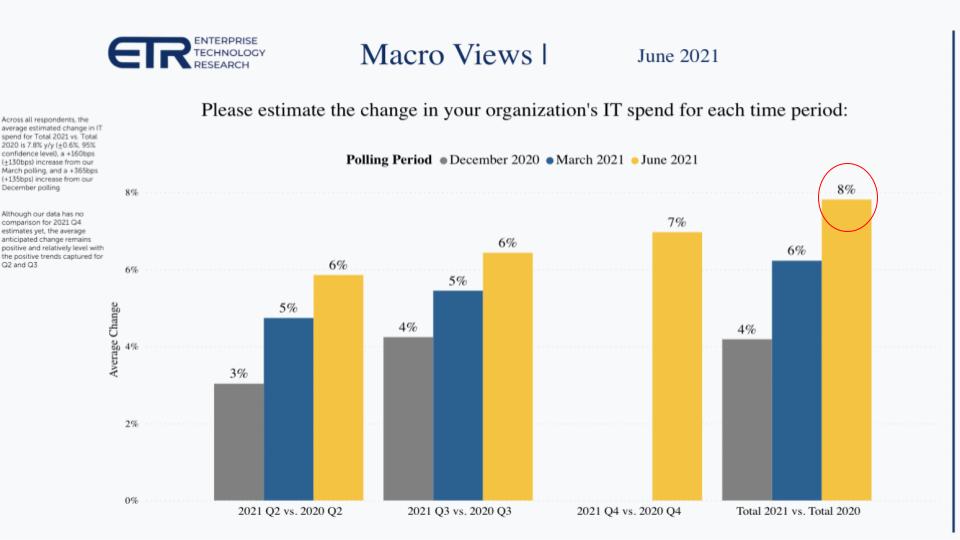

The chart above shows survey results comparing December 2020 with the March 2021 data and the most recent ETR survey. Erik Bradley explained this data as follows.

As you can see in the beginning part of the year, when we asked people, “What do you plan to spend throughout 2021?” They were saying it would be about a 4% increase. Which we were happy with because as you said last year, it was all negative. That continues to accelerate and is only hyper accelerating now as we head into the back half of the year. In addition, ETR hosts a panel of IT end users to get their feedback and add context to this data. In the panel, every participant expects a continued increase throughout next year.

While there are some concerns and uncertainty about what we’re seeing right now with COVID, chief information officers are planning their budgets for 2022 and the signs point to further increases going forward.

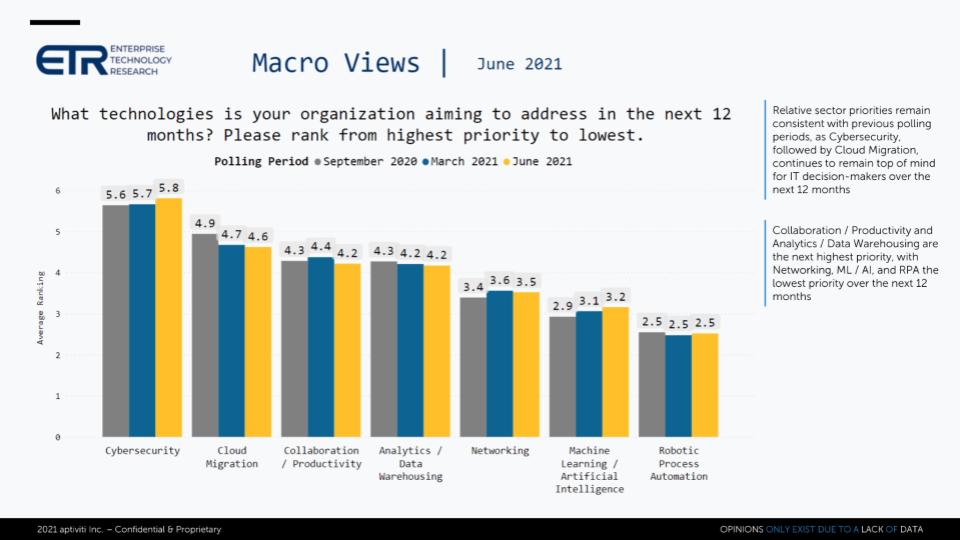

The chart below tracks spending priorities back to last September when believe cyber emerged as the No. 1 priority in the survey; ahead of cloud, collaboration, analytics/data and the other sectors. Note: These areas are the top seven and they outrank the many other sectors ETR tracks.

According to Erik Bradley, it’s all about security. This trend has been consistent due to the pivot to hybrid work. The fact that you’re behind the firewall one day and then working from home the next, switching in and out of networks, has heightened the focus on protecting organizations from adversaries. Hybrid work is a field day for bad actors and CIOs have no choice but to put resources into protecting their organizations. And the hybrid work trend is here to stay.

Going forward, ETR panel members indicate that they’re planning to accelerate some of the areas on the right side of the chart, particularly related to improving digital experiences and leverage more automation in the form of RPA. In addition, as cloud migration matures and organizations settle on their new cybersecurity spending priorities, organizations are planning to reload on the analytics side. All of these areas come together in support of digital.

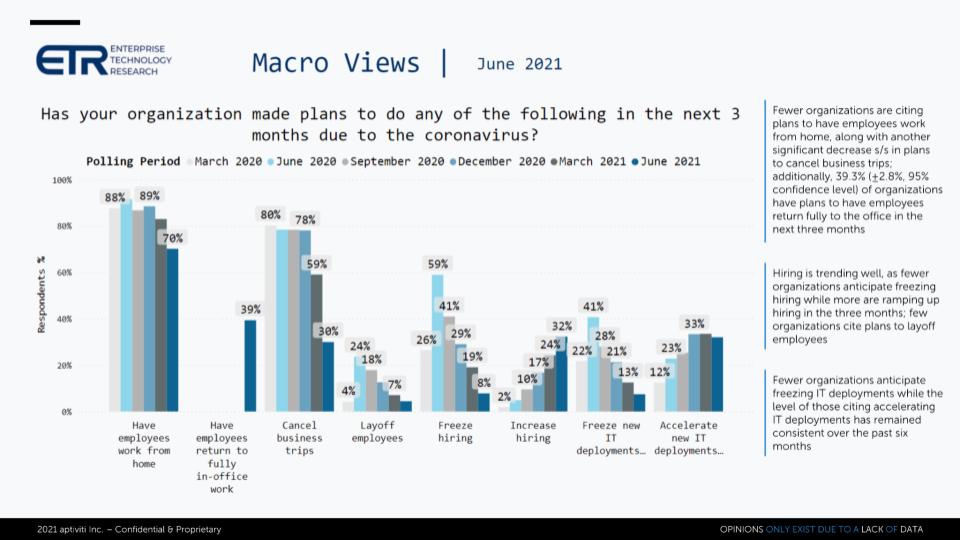

The data shown in the chart below tracks how CIOs and IT buyers have responded to the pandemic since last March. Some 70% of organizations still have employees working remotely but 39% now have employees fully returning to the office. And the rest of the metrics point toward positives for IT spending, although accelerating IT deployments at the right peaked as organizations realized last year that they had to invest in the future.

According to Erik Bradley, this is the slide for optimism. It points to more business travel and goes beyond just IT as you see hiring is up. As projected in our 2021 predictions post, some CIOs have indicated that they can’t hire enough people right now. They had to furlough employees last year and put a halt on projects that they now want to accelerate. But talent is very hard to find. This bodes well for automation and RPA.

The general sentiment among CIOs and IT buyers is that as they land on their hybrid workplace strategies, they’re extremely optimistic about the future and their ability to compete in a digital world.

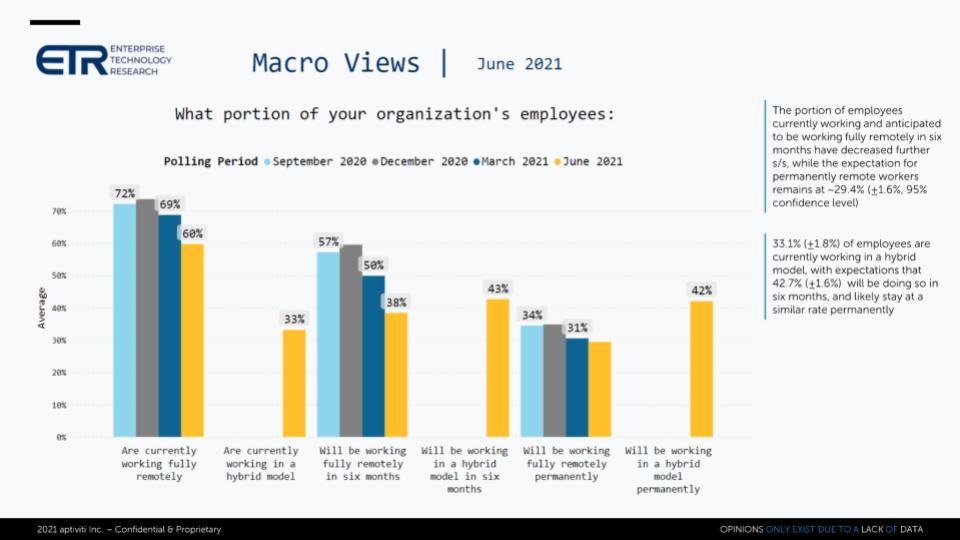

The chart below shows the time series of responses regarding work strategies from September 2020 to the most recent ETR survey.

Note that 60% of employees still work remotely with 33% in a hybrid model currently. CIOs expect to settle on about a 42% hybrid workforce, with around 30% working remotely, which is about double the historic norm.

CIOs in the ETR panel indicate that these expectations are subject to fluctuation based on COVID variants and vaccination policies in the workplace. So these data points should be interpreted as the ideal state organizations will pursue once they feel more confident about the post-pandemic situation.

Erik Bradley comments on hybrid work models and CIO sentiment.

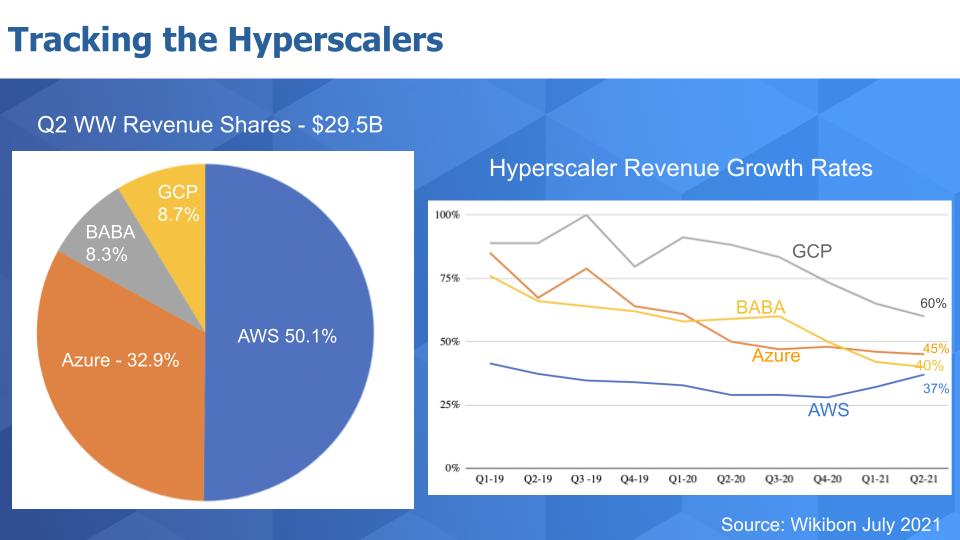

The chart bel0w shares the latest updates from the big four cloud players. It shows the Q2 revenue shares on the left and the growth rates for the players on the right back to Q1 2019.

First thing is these players generated just under $30 billion in the quarter, with Amazon Web Services capturing 50% of that. Azure tracks at about a third and Alibaba and Google Cloud Platform are roughly 8% to 9% of the market.

But what’s most notable is that AWS, which generated almost $15 billion in the quarter, was the only player to grow its revenue both sequentially and year over year. We believe Wall Street is missing the real story here on Amazon. The company announced earnings on Thursday night after the close. It had a 2% miss on the top line overall and a meaningful 22% beat on earning per share. So Amazon’s retail business missed its revenue targets but AWS saw a 4% revenue beat. The stock was off more than 7% after hours and into Friday.

Now to us, a mix shift toward AWS is actually great news for investors. Tepid guidance from Amazon is a negative but a shift to more profitable cloud business is a positive.

Investors were also concerned that Jassy didn’t participate in the earnings call and we hope he will in the future because he is such a strong communicator. Regardless, in our view, AWS funds Amazon’s entrance into new markets and a shift in product mix toward cloud is only good news for Amazon overall.

Further commentary on cloud and Amazon.

As we pointed out at the beginning of this segment, the world of digital and hybrid work and multi-cloud, it’s more complicated. This means to resolve issues like poor performance we need better visibility and that’s what the emergence of the observability market is all about.

The chart above plots Net Score or spending momentum on the vertical axis and Market Share or pervasiveness in the data set on the horizontal axis. And we’ve inserted a table that shows the data points in detail. The red dotted line is just our subjective mark in the sand for elevated spending levels.

There are three other points here. First, Splunk Inc. is well off its 2-year peak as highlighted in red. But SignalFx, which Splunk acquired in 2019 has made a big move northward since the last survey (note however SignalFx has a small Shared N number). Datadog Inc. also made a big move relative to the last survey on a much larger Shared N.

Erik Bradley made the following additional comments:

Bradley’s first point was to note that Splunk is showing an upward trend. Erik has highlighted the negative trend in Splunk over the past several quarters and this latest data set shows some positive rebounding for the company. Splunk has been trending down in the ETR data for almost two years now. This is the first time we’re seeing any positivity there.

In addition, for observability right now, it’s a “rising tide lifts all boats” scenario. The data across the board in analytics for these observability players is accelerating. None more so than Datadog and it’s thanks to the complexity coming from the increased cloud migration and multicloud scenarios. This is a perfect setup for Datadog, which is a cloud-native play.

Datadog has done a good job focusing on microservices and cloud observability, whereas legacy Splunk was narrowly focused on application monitoring. While Splunk is evolving, they were mainly aiming at on-prem application monitoring. Datadog came out as cloud-native and that has been a tailwind for the company.

Not only is Datadog leading in observability, it’s also leading the entire analytics sector. So without a doubt, that is the strongest that we’re seeing. It’s leading in terms of spending momentum – ahead of Dynatrace Inc. and Elastic NV, which is also doing well. The only play that really isn’t showing obvious momentum in the ETR data is Cisco Systems Inc.’s AppDynamics (not shown).

Overall, this market is really on fire. New Relic Inc. has shown a little bit of improvement as well. And what ETR panelists indicate is that because cloud migration is maturing, observability has to grow. Spending on this has to happen. So they all say the chart looks right. And it’s really just about the digital transformation maturity model.

As well, we’ve seen new entrants in the form of ServiceNow Inc., which acquired Lightstep and emerging companies such as ChaosSearch, Honeycomb and Observe, among others.

The chart below shows the same two dimensions as the previous graphic – Net Score on the vertical and Market Share on the horizontal plane. We’ve filtered the data on companies with a Shared N of 100 or greater.

As we’ve reported in previous Breaking Analysis episodes, Zscaler Inc. (cloud security stack), Okta Inc. (identity) and CrowdStrike Holdings Inc. (endpoint), with their modern platforms, are well-positioned for the shift to hybrid work. In addition CyberArk Software Ltd. shows momentum above the 40% watermark.

We remain optimistic about Palo Alto Networks Inc. Last year we analyzed the divergence in valuations between Palo Alto and Fortinet Inc. And based on our research and discussions with chief information security officers, we remained encouraged that Palo Alto would rebound and it has. The company has a strong presence in the market and is a major provider to leading organizations globally.

Microsoft Corp. is the other ubiquitous player. The strength of its Azure cloud and the associated cybersecurity tooling options in its portfolio confer a major advantage to the company. Microsoft is literally off the charts in the upper right of the ETR graphic.

Erik Bradley’s comments on cybersecurity.

Now here’s a quick snapshot of some of the players in the survey who show momentum and some that are showing signs of deceleration:

We haven’t mentioned Snowflake so far but they remain impressively elevated with regard to spending velocity. There are several other vendors of note in the chart below, which signals directional spending momentum in the ETR surveys.

According to Bradley, in regard to Snowflake Inc., you would expect a company that went public with that high of spending velocity to trail off. It would be natural. But it’s not moderating for Snowflake, in fact its Net Score is accelerating and gone even higher. It’s hitting all-time highs in the survey and we just don’t see it stopping anytime soon.

Another name to look at on here that is worth noting is Coupa Software Inc. It’s a great project expense management tool that got hit really hard during COVID as travel came to a halt and business expense reporting slowed. Bradley said he did a panel on this and lot of participants said “Yeah, it was the first thing I cut.” But he’s seeing a huge rebound of spending in that space as travel picks up. So that’s a name that worth calling out on the positive side.

Negative, if you look down to the bottom right of that chart, unfortunately we’re seeing some issues in RingCentral Inc. and Zoom Video Communications Inc. Anything that’s playing in this next videoconferencing and IP telephony market, seems to be having really decelerating spending. Also now with Zoom’s acquisition of Five9, it’s unclear how RingCentral is going to compete. IP telephony is shifting and this is the first time the ETR survey data has shown negative on this space since the pandemic.

Further, collaboration tools like Microsoft Teams and Slack put pressure on the need for phones. If we can just do a Slack call or a Teams call, it calls into question the need for IP telephony systems. This whole collaboration, productivity space is here to stay. And it’s got wide ranging implications to some of these more legacy type of tools.

We also want to call out Accenture. In our predictions session last year we said that the skill shortage was going to lead to an uptick in traditional services. We’ve certainly seen that and this data supports that trend.

Notably we see green upward arrows for some other names like Oracle Corp., Juniper Networks Inc. and Teradata Corp. along with Coupa, which we mentioned previously.

We put forth our scenario for the tech spending rebound. We believe last year tracked downward along with gross domestic product contraction.

People are concerned about inflation of course and the uncertainty around the Delta variant, though we feel as though boards and CEOs have mandated that tech execs build out digital platforms for the future that are data-centric, highly automated and intelligent. And that will take ongoing investment. Companies are flush with cash and leaders want to capitalize on shifting trends and leverage technology for competitive advantage.

Getting hybrid right is a major priority that directly impacts strategies around security, cloud, productivity of remote workers. And as we’ve said many times, we are entering a new era of data.

And we’re keeping an eye on this observability market. Cloud momentum, hybrid work and cross cloud complexity equate to a lot of interest in this area. Buyers have a number of choices. Do they go with a specialist? Or will they choose a feature of larger suites from mega cap software companies?

Erik Bradley’s closing comments.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU