BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Databases are the heart of enterprise computing.

The database market is both growing rapidly and evolving. Major forces transforming the market include cloud and data – of course – but also new workloads, advanced memory and input/output capabilities, new processor types, a massive push toward simplicity, new data sharing and governance models, and a spate of venture investment.

Snowflake Inc. stands out as the gold standard for operational excellence and go-to-market execution. The company has attracted the attention of customers, investors and competitors, and everyone from entrenched players to upstarts wants in on the act.

In this Breaking Analysis, we’ll share our most current thinking on the database marketplace and dig into Snowflake’s execution, some of its challenges and we’ll take a look at how others are making moves to solve customer challenges and angling to get their piece of the growing database pie.

Customers want to lower license costs, avoid database sprawl, run anywhere and manage new data types. These needs are often divergent and challenging for any one platform to accommodate.

The market is large and growing. Gartner has it at about $65 billion with a solid compound annual growth rate.

But the market as we know it is being redefined. Traditionally, databases served two broad use cases: transactions and reporting, for example data warehouses. But a diversity of workloads, new architectures and innovation have given rise to a number of types of databases to accommodate these diverse customer needs.

Billions have been invested in this market over the last several years and venture money continues to pour in. Just to give you some examples: Snowflake raised about $1.4 billion before its initial public offering. Redis Labs has raised more than a half-billion dollars so far, Cockroach Labs more than $350 million, Couchbase $250 million, SingleStore $238 million, Yellowbrick Data $173 million, and if you stretch the definition to no-code/low-code, Airtable has raised more than $600 million. And that’s by no means a complete list.

Why all this investment? In large part because the total available market is large, growing and being redefined.

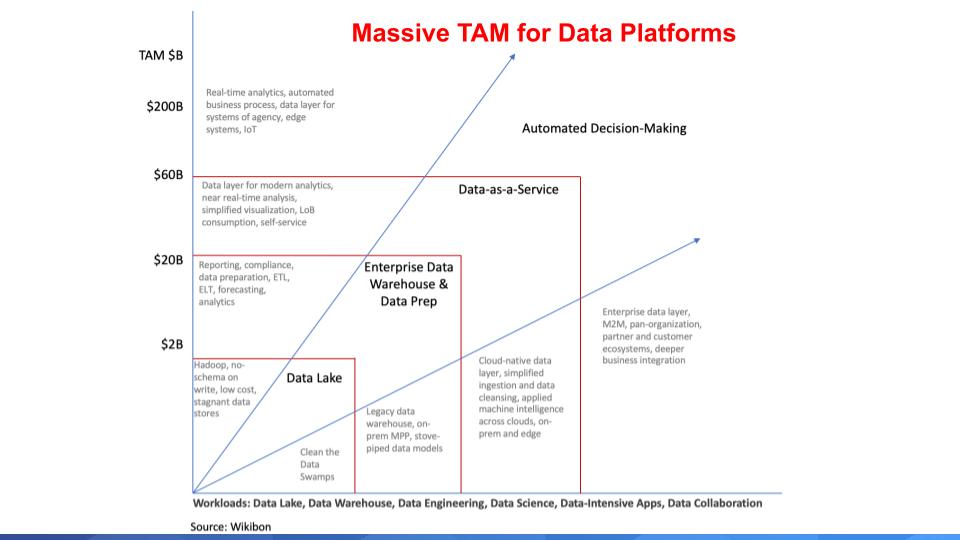

We no longer look at the TAM in terms of database products. Rather, we think of the market in terms of the potential for data platforms. Platform is an overused term, but in the context of digital, it allows organizations to build integrated solutions by combining data from ecosystems; or specialized and targeted offerings within industries. Below is a chart we’ve shown previously to describe the potential market for data platforms.

Cloud and cloud-native technologies have changed the way we think about databases. Virtually 100% of the database players have pivoted to a cloud-first strategy and many, like Snowflake, have a cloud-only strategy. Databases historically have been very difficult to manage and highly sensitive to latency, requiring lots of tuning. Cloud allows you to throw infinite resources on-demand to attack performance problems and scale up very quickly.

Data-as-a-service is becoming a staple of digital transformations and a layer is forming that supports data sharing across ecosystems. This is a fundamental value proposition of Snowflake and one of the most important aspects of its offering. Snowflake tracks a metric called edges, which are external connections in its data cloud. It claims that 15% of its total shared connections are edges and edges are growing 33% quarter-on-quarter.

The notion of sharing is changing the way people think about data. We use terms such as data as an asset. This is the language of the 2010s. We don’t share our assets with others, do we? No, we protect them, secure them, even hide them. But we absolutely want to share our data.

In a recent conversation with Forrester analyst Michele Goetz, we agreed to scrub data-as-an-asset from our phraseology. Increasingly people are looking at sharing as a way to create data products and data services which can be monetized. This is an underpinning of Zhamak Dehghani’s concept of a data mesh. Make data discoverable, shareable and securely governed so that we can build data products and data services.

This is where the TAM just explodes and the database market is redefined. We believe the potential is in the hundreds of billions of dollars and transcends point database products.

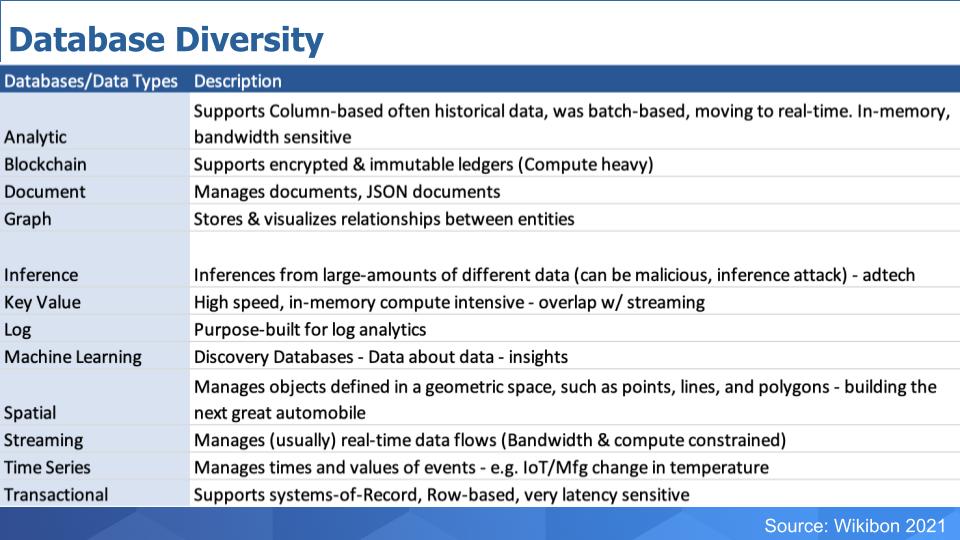

Historically, databases used to support either transactional or analytic workloads – the bottom and top lines in this table below:

But the types of databases have mushroomed. Just look at this list. Blockchain is a specialized type of database in and of itself and is now being incorporated into platforms; Oracle is notable for incorporating blockchain into its offering.

Document databases support JSON and graph data stores assist in visualizing data. Inference from multiple different sources has been popular in ad tech. Key-value stores have emerged to support workloads such as recommendation engines. Log databases are purpose-built. Machine learning is finding its way into databases and data lakes to enhance insights: Think BigQuery and Databricks. Spatial databases help build the next generation of products such as advanced autos. Streaming databases manage real-time data flows, and there’s also time-series databases.

Perhaps we’ve even missed a few, but you get the point.

The above logo slide is by no means exhaustive. Many companies want in on the action, including firms that have been around forever such as Oracle Corp., IBM Corp., Teradata Corp. and Microsoft Corp.. These are the Tier 1 relational databases that have matured over the years with properties such as atomicity, consistency, isolation and durability – what’s known as ACID properties.

Some others you may or may not be familiar with. Yellowbrick Data is going after the best price/performance in analytics and optimizing to take advantage of both hybrid installations and the latest hardware innovations.

SingleStore, formerly known as Memsql, is aiming at high-end analytics and transactions and mixed workloads at very high speed – we’re talking trillions of rows per second ingested and queried.

There’s Couchbase with hybrid transactions and analytics. Redis Labs’ open-source NoSQL is doing very well, as is Cockroach with distributed SQL. MariaDB has managed MySQL. Mongo has its document database, EnterpriseDB supports Postgres. And if you stretch the definition a bit, there’s Splunk for log database, and ChaosSearch is a really interesting startup that leaves data in S3 and is going after simplifying the so-called ELK stack.

New Relic has a purpose-built database for application performance management. We could even put Workday Inc. in the mix since it developed a purpose-built database for its apps.

And we can’t forget SAP SE with HANA trying to pry customers off of Oracle, and of course the Big Three cloud players, Amazon Web Services Inc., Microsoft and Google LLC with extremely large portfolios of database offerings.

The spectrum of products is wide, with AWS, which has somewhere around 16 database offerings, all the way to Oracle, which has one database to do everything, notwithstanding MySQL and its recent Heatwave announcement. But generally Oracle is investing to make its database run any workload, while AWS has a “right tool for the right job” approach.

There are lots of ways to skin a cat in this enormous and strategic enterprise market.

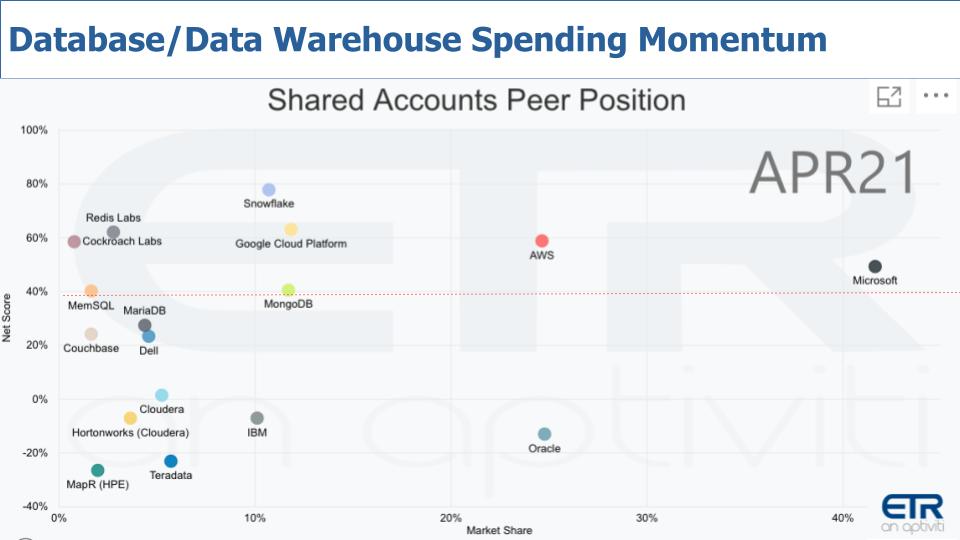

The chart below is one of the views we like to share quite often within the ETR data set. It shows the database players across 1,500 respondents and measures their Net Score, which is spending momentum, on the Y axis, and Market Share, which is pervasiveness in the survey, on the X axis.

Snowflake is notable because it has been hovering around 80% Net Score since the survey started tracking the company. Anything above 40% – that red line – is considered by us to be elevated.

Microsoft and AWS are especially notable as well because they have both market presence and spending velocity with their platforms.

Oracle is prominent on the X axis, but it doesn’t have the spending velocity in the survey because nearly 30% of Oracle installations are spending less whereas only 22% are spending more. Now, as a caution, this survey doesn’t measure dollars spent and Oracle will be skewed toward large customers with big budgets – so consider that caveat when evaluating this data.

IBM is in a similar position as Oracle, although its Market Share is not keeping pace with the market leader.

Google has great tech, especially with BigQuery and it has elevated momentum – so not a bad spot, although we suspect it would like to be closer to AWS and Microsoft on the horizontal axis.

And some of the others we mentioned earlier such as MemSQL (now SingleStore), Couchbase, Redis, MongoDB and MariaDB, all with very solid scores on the vertical axis.

Cloudera Inc. just announced it’s selling to private equity and that will hopefully give it time to invest in its platform and get off the quarterly shot clock. MapR was acquired by HPE in 2019 and is part of Hewlett Packard Enterprise Co.’s Ezmeral platform, which doesn’t yet have the market presence in the survey

Now something that is interesting in looking at Snowflake’s earnings last quarter is its “laser focus” on large customers. This is a hallmark of Chief Executive Frank Slootman and Chief Financial Officer Mike Scarpelli, as they certainly know how to go whale hunting.

The chart above isolates the data to the Global 1000. Note that both AWS and Snowflake go up on the Y axis – meaning large customers are spending at a faster rate for these two companies.

The previous data view had an N of 161 for Snowflake and a 77% Net Score. This chart shows data from 48 G1000 accounts and the Net Score jumps to 85%. When you isolate on the 59 F1000 accounts in the ETR data set, Snowflake jumps an additional 100 basis points. When you cut the data by F500, there are 40 Snowflake accounts and their Net Score jumps another 200 basis points to 88%. Finally, when you isolate on the 18 F100 accounts, Snowflake’s Net Score jumps to 89%. So it is strong confirmation in the ETR data that Snowflake’s large account strategy is working.

And because we think Snowflake is sticky — this is probably a good sign for the future.

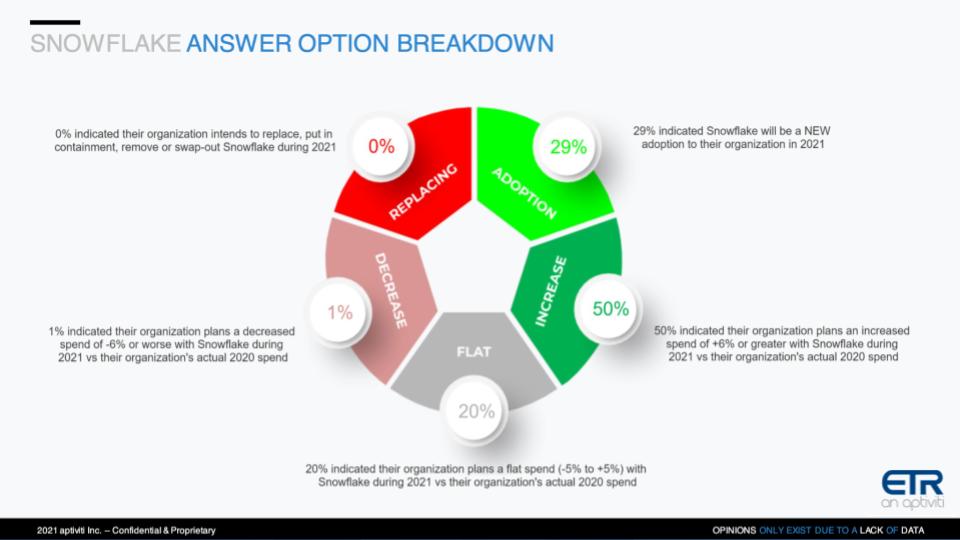

We talk about Net Score a lot as its a key measure in the ETR data, so we’d like to just quickly remind you what that is and use Snowflake as the example.

This wheel chart above shows the components of Net Score. The lime green is new adoptions – 29% of the Snowflake customers in the ETR data set are new to Snowflake. That is pretty impressive. Fifty percent of the customers are spending more – that’s the forest green. Twenty percent are flat from a spending perspective – that’s the gray area. Only 1% – the pink – are spending less and 0% are replacing Snowflake. Subtract the red from the green and you get a Net Score of 78% — which is tremendous and is a figure that has been steady for many quarters.

Remember as well, it typically takes Snowflake customers many months – like six to nine months – to start consuming its services at the contracted rate. So those 29% new adoptions won’t kick into high gear until next year.

This bodes well for Snowflake’s future revenue.

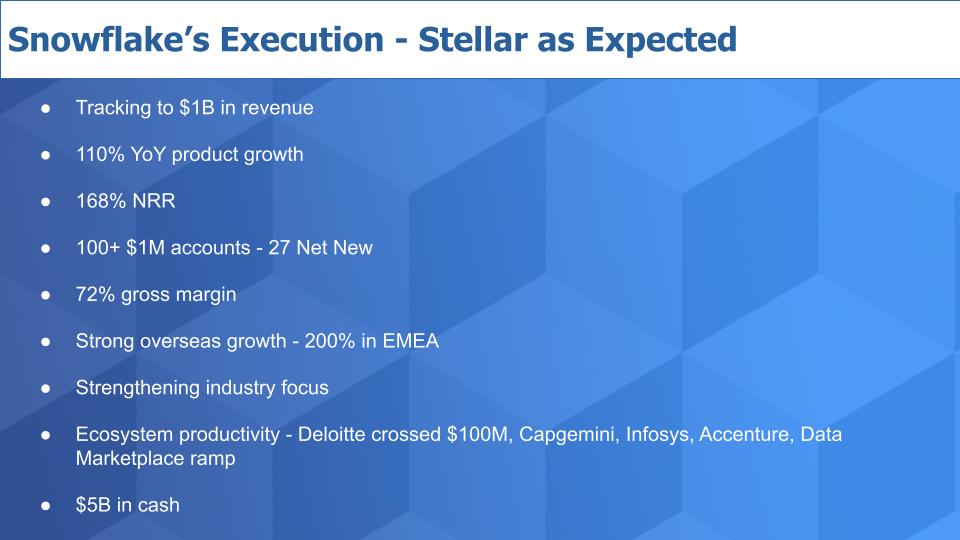

Let’s just do a quick rundown of Snowflake’s numbers. The company’s product revenue run rate is now at $856 million and it will pass $1 billion on a run-rate basis this year. The growth is off the charts with a very high Net Revenue Retention. We’ve explained previously that Snowflake’s consumption pricing model means it must account for retention differently than a SaaS company would.

Snowflake added 27 net new $1 million accounts in the quarter and claims to have more than 100 now. It also is just getting its groove swing going overseas. Slootman says he’s personally going to spend more time in Europe given his belief that the market is large, and of course he’s from the continent. And gross margins expanded thanks in large part to a renegotiation of its cloud costs. We’ll come back to that.

It’s also moving from a product-led growth company to one that’s focused on core industries – with media and entertainment being one of the largest along with financial services. To us, this is really interesting because Disney is an example Snowflake often puts forth as a reference and we believe it’s a good example of using data and analytics both to target customers and to build so-called data products through data sharing.

Snowflake must grow its ecosystem to live up to its lofty expectations and indications are the large system integrators are leaning in big-time – with Deloitte crossing $100 million in deal flow.

And the balance sheet is looking good. The snarks will focus on the losses, but this story is all about growth, customer acquisition, adoption, loyalty and lifetime value.

We said at IPO – and always say this – there almost always will be better buying opportunities ahead for stocks than on day one.

Above is a chart of Snowflake’s performance since IPO. We have to admit, it has held up pretty well and is trading above its first-day close. As predicted, there were better opportunities than day one, but you have to make the call from here. Don’t take our stock-picking advice, do your research. Snowflake is priced to perfection so any disappointment will be met with selling, but it seems investors have supported the stock pretty well when it dips.

You saw a pullback the day after Snowflake crushed its most recent earnings because its guidance for revenue growth for next quarter wasn’t in the triple digits, moderating into the 80s.

And Snowflake pointed to a new storage compression feature that will lower customer costs and consequently revenue. Although this makes sense in the near term, it may be another creative way for Scarpelli to dampen enthusiasm and keep expectations from getting out of control. Regardless, over the long term, we believe a drop in storage costs will catalyze more buying. And Snowflake alluded to that on its earnings call.

There’s an interesting conversation going on in Silicon Valley right now around the cloud paradox. What is that?

Martin Casado of Andreessen Horowitz wrote an article with Sarah Wang calling into question the merits of SaaS companies sticking with the cloud at scale. The basic premise is that, for startups and in the early stages of growth, the cloud is a no-brainer for SaaS companies. But at scale, the cost of cloud approaches 50% of the cost of revenue and becomes an albatross that stifles operating leverage.

Their conclusion is that as much as $500 billion in market cap is being vacuumed away by the hyperscalers. And that cloud repatriation is an inevitable path for large SaaS companies at scale.

We were particularly interested in this because we had recently put out a post on the cloud repatriation myth. But I think in this instance there’s some merit to their conclusions. I don’t think it necessarily bleeds into traditional enterprise settings but for SaaS companies, maybe ServiceNow Inc. has it right, running its own data centers. Or maybe a hybrid cloud approach to hedge bets and save money down the road is prudent.

What caught our attention in reading through some of the Snowflake docs such as the S-1 and its most recent 10-K were comments regarding long-term purchase commitments and noncancellable contracts with cloud companies. In the company’s S-1, there was a disclosure of $247 million in purchase commitments over a five-plus-year period. In the company’s latest 10-K report, that same line item jumped to $1.8 billion.

So Snowflake is clearly managing these costs, as it alluded to on its earnings call, but one wonders: Will Snowflake at some point follow the example of Dropbox and start managing its own information technology, or will it stick with the cloud and negotiate hard?

It certainly has the leverage: Snowflake has to be one of Amazon’s best partners and customers, even though it competes aggressively with Redshift. But on the earnings call, Scarpelli said Snowflakeis working on a new chip technology to increase performance dramatically. Hmmm. Not sure what that means. Is that taking advantage of AWS Graviton or is there some other deep-in-the-weeds other going on inside Snowflake?

We’re going to leave it there for now and keep following this trend.

It’s clear that Snowflake is the pacesetter in this new exciting world of data. But there’s plenty of room for others. And Snowflake still has lots to prove to live up to its lofty valuation. One customer in an ETR CTO roundtable expressed skepticism that Snowflake will live up to the hype because its success will lead to more competition from well established players.

This is a common theme and an easy to reach conclusion. But our guess is it’s the exact type of narrative that fuels Slootman and sucked him back into this game of thrones.

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU